Calculate sales tax and total cost given your state Calculate Sales Tax Percentage From Total. Enter thing cost and tax rate percentage to find sales tax and total cost. To calculate the sales tax that is remembered for an organization’s receipts, partition the total sum got (for the things that are dependent upon sales tax) by “1 + the sales tax rate”. At the end of the day, assuming the sales tax rate is 6%, partition the sales taxable receipts by 1.06. In the event that the sales tax rate is 7.25%, partition the sales taxable receipts by 1.0725.

Most business visionaries have known about Fraction to a Percent on a Calculator, however it involves disarray and dread for some. As an individual business person, your most memorable inquiry may be whether you really want to cover sales tax, and on the off chance that you do, what the sales tax percentage is and how it applies to your items.

Thing is, it isn’t so clear: there are a few guidelines to Calculate Sales Tax Percentage From Total, contingent upon your business, state, and numerous different special cases. To guarantee your computation is right and powerful, how about we dive into the fundamentals of sales tax and how to record it proficiently.

What is Sales Tax?

Sales tax is a tax on the offer of labor and products. In the US and the Locale of Columbia all states with the exception of The Frozen North, Delaware, Montana, New Hampshire and Oregon force a state sales tax when you purchase things or pay for administrations. Gold country however permits areas to charge nearby sales taxes as do numerous different states.

A few states don’t charge sales tax on unambiguous classes of things. In Massachusetts for instance sales tax isn’t charged on normal staple things. Likewise many states have extra tax overcharges. In the friendliness business it is normal for cafés and lodgings to charge a tax rate higher than the state sales tax rate. Check with your state and territory for expected sales tax rates and potential tax overcharge rates.

Calculate Sales Tax

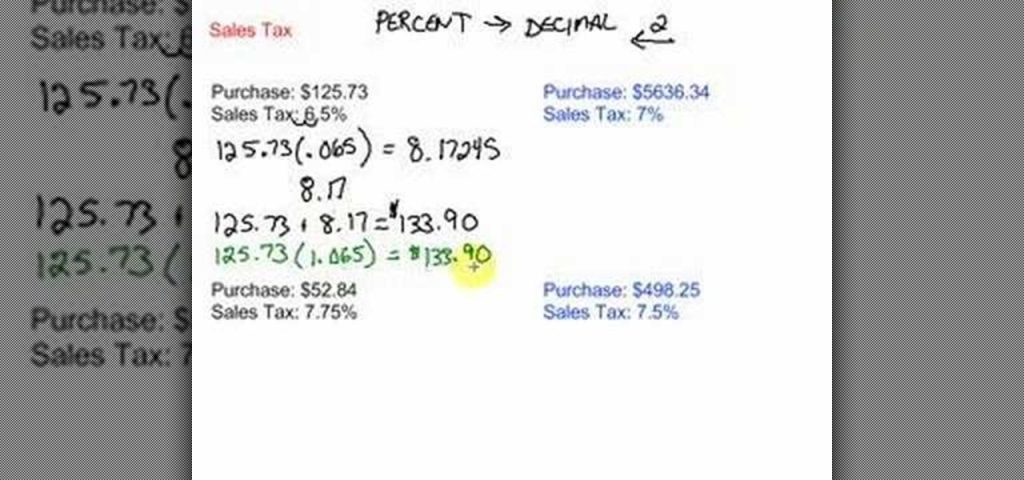

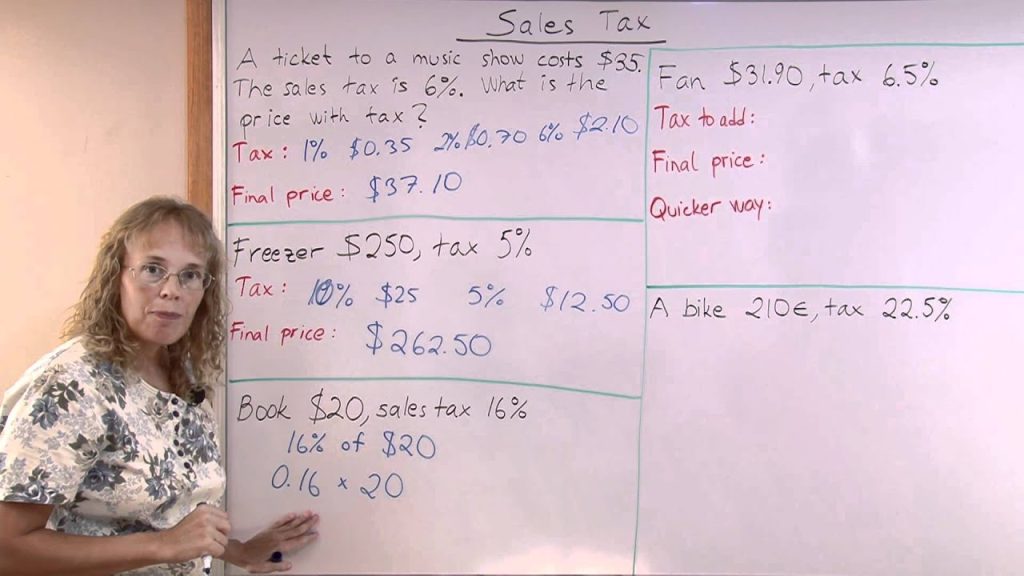

Duplicate the cost of your thing or administration by the tax rate. On the off chance that you have tax rate as a percentage, partition that number by 100 to get tax rate as a decimal. Then utilize this number in the augmentation cycle.

- Find list cost and tax percentage

- Partition tax percentage by 100 to get tax rate as a decimal

- Duplicate rundown cost by decimal tax rate to get tax sum

- Add tax add up to list cost to get total cost

For instance say you’re purchasing another espresso creator for your kitchen. The cost of the espresso creator is $70 and your Calculate Sales Tax Percentage From Total is 6.5%.

- List cost is $90 and tax percentage is 6.5%

- Partition tax percentage by 100: 6.5/100 = 0.065

- Duplicate cost by decimal tax rate: 70 * 0.065 = 4.55

You will pay $4.55 in tax on a $70 thing - Add tax to list cost to get total cost: 70 + 4.55 = $74.55

Sales Tax Computation Equations

- Sales tax rate = sales tax percent/100

- Sales tax = list cost * sales tax rate

- Total cost including tax = list cost + sales tax, or

- Total cost including tax = list cost + (list cost * sales tax rate), or

- Total cost including tax = list cost * ( 1 + sales tax rate)

Assuming that you want to calculate state sales tax, use tax and neighborhood sales tax see the State and Nearby Sales Tax Calculator.

To Close

The most ideal way to guarantee opportune and precise Calculate Sales Tax Percentage From Total is to empower automation. Alongside this, counseling accounting experts like Fincent will assist you with saving valuable hours on dealing with your books so you can zero in on developing your business.

Leave a Reply