Sales tax is an additional expense for the labor and products you’re selling and is utilized to help the operation of local and state legislatures. Knowing how to charge sales tax isn’t always a straightforward cycle, as the sales tax rules are different at all levels. A few states have a Calculate Sales Tax on a Calculator that local municipalities can add to, while different states have no sales tax at all.

This online sales tax calculator takes care of multiple issues around the tax imposed on the sale of labor and products. It can calculate the gross price based on the net price and the tax rate, or work the opposite way around as a converse sales tax calculator. The sales tax Generator framework in the United States is somewhat complicated as the rate is different depending on the state and the base of the tax.

If you might want to get more insight into this topic, you can read underneath to find out about what sales tax is, what is the difference between sales tax and value-added tax, what is its history, how to calculate sales tax and what it looks like in various U.S. states together its economic implications.

The tension is on while you’re trying to factor in “extra expenses” while buying an item from a retailer or ordering food from a restaurant. The reality is that those seemingly small sales tax percentages that get tacked to the furthest limit of each and every purchase can add up to something pretty significant over the long haul. That means you want to know how to add in Calculate Sales Tax on a Calculator and accurately if you’re trying to stay within a certain overall spending plan. Don’t fail to remember that sales tax can also be deductible on your tax return.

What is Sales Tax?

A sales tax is a consumption tax paid to an administration on the sale of certain labor and products. Usually, the vendor gathers the sales tax from the consumer as the consumer makes a purchase. In many countries, the sales tax is called value-added tax (VAT) or labor and products tax (GST), which is a different type of consumption tax. In certain countries, the listed prices for labor and products are the before Calculate Sales Tax on a Calculator, and a sales tax is only applied during the purchase. In different countries, the listed prices are the final after-tax values, which include the sales tax.

What is the reason for sales tax?

Sales tax is utilized to finance a large group of municipal and state needs that range from infrastructure to community needs. All states use sales taxes in various ways, yet the intent behind their collection is to maintain or improve the quality of life for the residents of a given municipality and the overall state. A portion of the ways sales taxes are utilized include:

- Road construction and maintenance

- Law implementation

- Construction of community amenities

- Schools

- Fire departments

- General assets

The state sets a base sales tax rate, and local legislatures are allowed to add their own tax to the rate. For example, the state sets its rate at 3.25%, the area adds another 1.25%, and the local government adds another .half. That’s three taxing bodies collecting sales tax on purchases for a total of 5%. You, as a vender, are required to split up these taxes and remit them to their respective taxing bodies.

How do you calculate sales tax?

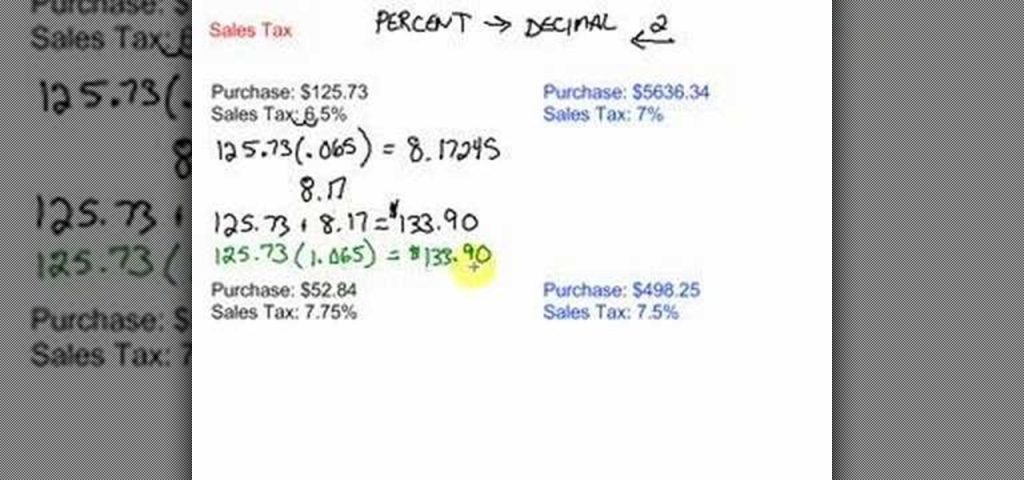

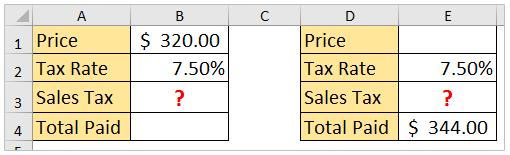

Learning how to calculate sales tax is easy. It consists of converting the Calculate Sales Tax on a Calculator to a decimal number, then multiplying the expense of the item by the decimal number to get the amount of sales tax you gather.

Sometimes, a sales tax percentage is easy to calculate, for example, a 10% tax rate. For example, 10% of $12.00 is $1.20. Add the numbers together, and you get a final sales price of $13.20 with tax. You may still really like to utilize the formula when the item amount is harder to calculate, for example, $13.52, or when the sales tax percentage has quarter points in the rate, for example, 9.75%.

What is the sales tax formula?

The formula for sales tax is a simple algebra equation that involves converting a percentage to a decimal, then, at that point, using the decimal as a multiplier on the expense of the item to get the final sales tax amount.

At the point when written out, the equation seems to be this:

- Sales tax rate = Sales tax percent/100

- Sales tax = List price x Sales tax rate

In the occasion the tax rate is a percentage, you drop the percentage sign and divide the tax amount by 100 to get the decimal numbers for the tax rate. Or on the other hand you can move the decimal point two places to one side, which places a 0 in front of the sales tax percentage. A 10.00% sales tax becomes .010. Multiply the price of the item with the decimal tax number to get the tax amount. Add the sales tax number to the price of the merchandise at the final cost.

Example of a sales tax calculation

Here is a glance at the Calculate Sales Tax on a Calculator in action with an item that costs $50 and a sales tax rate of 5%:

- $50 x .05 = $2.50 for a total of $52.50.

- The 5% got transformed into the decimal number of .05 and was multiplied against $50, resulting in a sales tax amount of $2.50.

- We should take a gander at how it functions with a sales tax of 9.25%.

- $50 x .0925 = 4.63 for a total of $54.63.

The Labor and products Tax (GST) is similar to VAT. It is an indirect sales tax applied to certain labor and products at multiple instances in a store network. Taxations across multiple countries that impose either a “GST” or “VAT” are so vastly different that neither word can appropriately define them. The countries that define their “sales tax” as a GST are Spain, Greece, India, Canada, Singapore, and Malaysia.

Leave a Reply