Know initially your equilibrium and interest installments on any loan with this basic loan calculator in Excel. Simply enter the loan sum, interest rate, loan term, and begin date into the Create Loan Calculator in Excel. It will ascertain every month to month principal and interest cost through the final installment.

Extraordinary for both present moment and long haul loans, the loan reimbursement calculator in Excel can be a decent reference while considering result or refinancing. Loan Calculator and assume responsibility for your financial commitments. This is an open layout.

Bookkeeping sheets are integral assets that assist you with understanding how a loan functions. They make it simple to see significant insights concerning your loan, and the estimations are pretty much automated. You could utilize pre-fabricated loan amortization layouts that permit you to just enter a couple of insights regarding your loan.

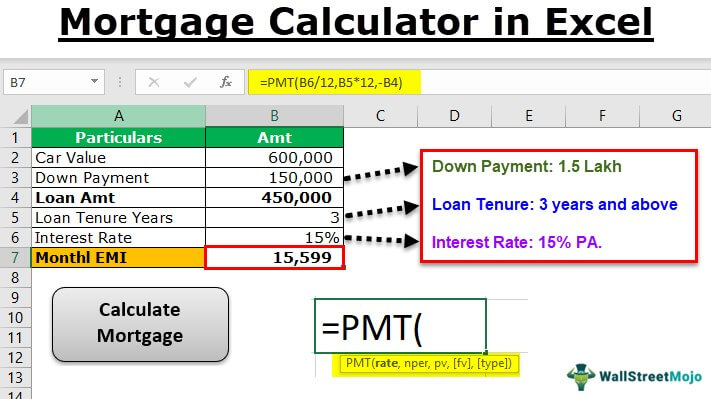

This article shows you how to create a home loan calculator with a prepayment choice in an Excel sheet. Using a home Create Loan Calculator in Excel, you can without much of a stretch work out the EMI, month to month interest, remaining principal sum, and so forth. Here, we will take you through a simple and helpful strategy on how to create a home loan calculator with a prepayment choice in an Excel sheet.

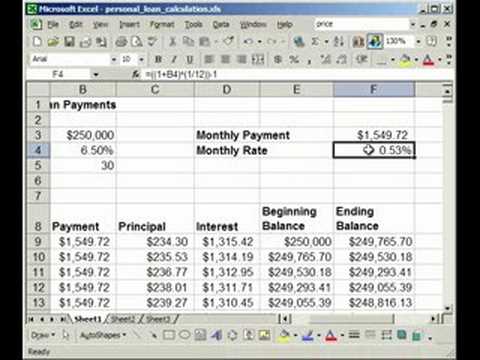

How to create a loan amortization plan in Excel

To fabricate a loan or home loan amortization plan in Excel, we should utilize the following capabilities:

- PMT capability – computes the total measure of an intermittent installment. This sum stays steady for the whole length of the loan.

- PPMT capability – gets the principal part of every installment that goes toward the loan principal, for example the sum you acquired. This sum increases for resulting installments.

- IPMT capability – finds the interest part of every installment that goes toward interest. This sum diminishes with every installment.

Presently, we should go through the cycle bit by bit.

How to Fabricate an Excel Loan Model

Doing it yourself requires greater investment, however you’ll foster financial information and bookkeeping sheet abilities you can’t get from a format. In addition, you can customize however much you might want. All things considered, after you’ve done this a couple of times, you could find it quicker to utilize a layout to begin the interaction, then, at that point “Create Loan Calculator in Excel” the format and make your changes.

Suppose you need a model that shows you each yearly or regularly scheduled installment. Begin at the top line of your accounting sheet and add the following area titles to each column (where you’ll enter information about your loan):

- Loan sum

- Interest rate

- Number of periods (or loan term)

Give those cells a green fill tone, which lets you know that you can change those qualities as you look at loans and run imagine a scenario in which situations.

How You Can Manage Your Accounting sheet

Whenever you have your loan demonstrated, you can glean tons of useful knowledge about your loan:

- Amortization table: Your calculation sheet shows an amortization table, which you can use to create an assortment of line outlines. Perceive how your loan gets compensated off after some time, or how much you’ll owe on your loan at some random date later on.

- Principal and interest: The accounting sheet likewise shows how every installment is broken into principal and interest. You’ll comprehend how much it expenses to get, and how those costs change after some time. Your installment remains something similar, yet you’ll pay less interest with every regularly scheduled installment.

- Regularly scheduled installment: Your bookkeeping sheet will perform basic estimations also. For instance, you’ll have to ascertain the regularly scheduled Create Loan Calculator in Excel. Changing the loan sum (in the event that you consider buying something more affordable, for instance) will influence your expected regularly scheduled installment.

- “Consider the possibility that” situations: The advantage of using bookkeeping sheets is that you have the computing ability to roll out however many improvements to the model as you need. Verify what might occur assuming that you make extra installments on your loan. Then see what occurs assuming you acquire less (or more). With a bookkeeping sheet, you can refresh the inputs and find instant solutions.

Every one of the contentions are equivalent to in the PMT recipe, aside from the per contention that determines the installment time frame. This contention is provided as a general cell reference (A8) in light of the fact that it should change in view of the overall place of a line to which the recipe is replicated.

Leave a Reply