While doing work that as often as possible involves charge rates, using a calculator that automatically applies the ongoing expense rate Set GST in Calculator. Both independent and programming calculators include such expense rate highlights, however they not norm, and just a few creators include the capability. Setting the expense rate permits you to manage different assessment conditions or changes to burden rates.

GST represents Labor and products Expense. Calculating GST will be made simple, with these basic advances. We are going to work out it together. In some cases calculating GST as an entrepreneur can be precarious; furthermore, you have such countless different things on your plate that you would rather not invest your energy and brainpower on little maths totals like adding and subtracting GST.

That is the reason we made our new Set GST in Calculator — on the grounds that we need to assist entrepreneurs who with needing a simple to-utilize, relatively straightforward tool that assists them with calculating GST rapidly. A type of duty is indirect and forced on the stock of labor and products. It is these days essential to know how to auto compute GST in count.

How to Utilize the GST calculator

In the event that you have a value that doesn’t include GST however you really want it to, simply add that cost into the main field and snap the ‘Add GST’ button. The calculator will do the maths for yourself and show you the cost with GST in the ‘Cost’ field (and the GST that the cost contains in the ‘GST’ field).

On the off chance that you have a value that incorporates GST and you need to find out what the cost would be without GST, enter the cost in the principal field, click ‘GST Calculator‘, and you’ll find the original cost in the ‘Cost’ field and how much GST in the ‘GST’ field.

Simple Stunts to Compute GST

Since GST is 10% of the deal value, the calculator adds 10% of the cost to add Set GST in Calculator, or deducts 10% if your cost as of now includes GST and you need to find out the original cost.

Here is the maths behind it.

Adding GST:

To ascertain how much GST to add, simply increase the sum by 0.1.

To compute a total value, that includes GST, simply duplicate the sum by 1.1.

Subtracting GST:

To compute how much GST is included in a cost, simply partition by 11.

To ascertain how much the cost was before GST, simply partition by 1.1.

That is a ton of manual work for entrepreneurs to do each time they need o compute GST — utilize our calculator instead.

Independent calculators with charge rate capabilities

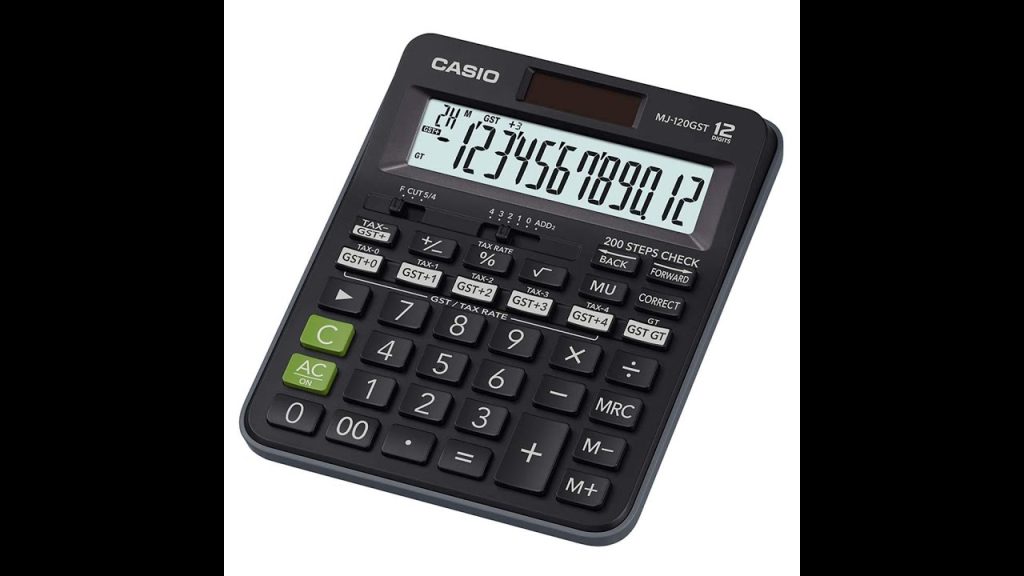

Finding calculators with charge rate keys is easy. Calculator makers, for example, Texas Instruments, Ordinance and Casio offer expense capabilities on both printing and non-printing calculators, at an assortment of costs. Restrictive brand calculators presented by office supply retailers may likewise be accessible with charge capabilities. Calculators with charge capabilities might utilize two keys, Set GST in Calculator+ and Expense , to add or deduct the duty rate to a sum, or instead may utilize a single Assessment key in combination with in addition to and minus keys. A few models could likewise include a different RATE key, instead of using key combinations to store charge settings on the calculator.

Using charge capabilities on independent elements

While every maker carries out various strategies to program charge rates, the general advances are normal. On calculators without a RATE key, words, for example, “SET,” RATE,” or “RATE SET” will be printed over a key on the calculator case. Pressing and holding another key readies the calculator to acknowledge your duty rate. For instance, to add 13% expense rate on a Casio calculator, press and hold the “air conditioner” key and press the “%” key – – which has the word SET printed above it – – for two seconds, then, at that point, enter “13.0” and press the “air conditioner” key. The TAX+ and Duty keys will presently add or take away 13%. Check the producer’s instructions for the particular advances your calculator requires.

Programming calculators with charge rate capabilities

Programming calculators frequently emulate both the highlights and plan of independent calculators. Charge capabilities aren’t standard in the product world either, however are included for certain bundles and programmable into others. Moffsoft Calculator 2 includes a single Expense key, while RUCalc utilizes the TAX+ and Duty double key strategy. The two strategies work in similar way as independent calculators. Set GST in Calculator rendition permits two custom keys that can be modified for setting charge rates. The RUCalc programming is free and, while Moffsoft offers a free variant, it doesn’t include charge key capabilities.

Using tax functions in software

Change charge rates on programming calculators using choices, client capabilities or inclinations, depending on which programming you are using. For instance, on the RUCalc, set the duty rate by clicking “Choices” from the menu bar, selecting “Inclinations,” then (in light of the past model) typing “13.0” into the Expense Worth box.

Leave a Reply