Work Out GST on Calculator Assuming that you are the proprietor of any business or engaging in the buy or supply of products, then you really want to pay tax under the GST system. GST calculator will assist you with finding out the GST pace of the item as well as separate in the class of the GST rate. In this article, we will know how to calculate GST and about the GST calculator.

GST is a single tax that is forced on the inventory of merchandise and products. GST’s main expects to bring a brought together market for the entire nations. It is a multi-stage, thorough, destination-put together tax forced with respect to all esteem addition. Some products like petroleum, liquor, power don’t go under the GST tax.

Calculate GST with this straightforward Indian GST on calculator. It tends to be utilized as well as converse Labor and products calculator. Computing GST inclusive and selective prices is simple.

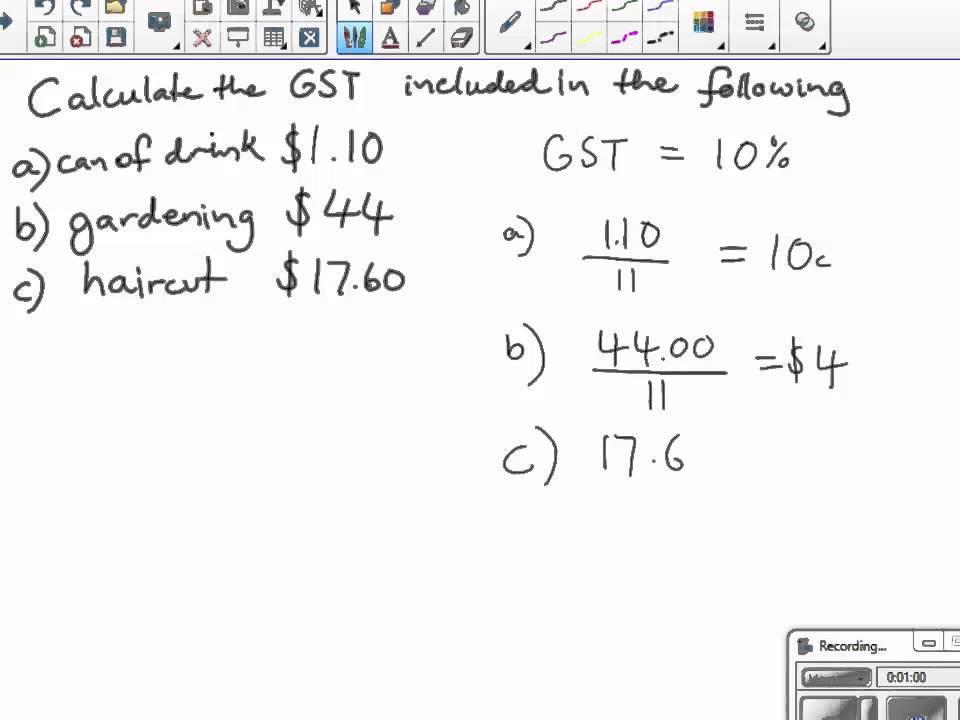

This Australian GST calculator adds 10% to determine a GST-inclusive sum, and likewise permits an opposite calculation to determine an included GST sum, or the cost without GST included.

The GST rate is regularly 10% of taxable worth. To add GST, duplicate the cost by 1.1. To find a cost without GST (invert calculator), partition the cost by 1.1

What is GST on Calculator?

GST calculator is a sort of calculator that is utilized to determine the exact payable measure of GST on a monthly or quarterly. Age Calculator

How to Calculate GST?

For the taxpayer, It is currently conceivable to realize tax rates forced at various points on a few products or services under the GST system. The taxpayer ought to realize the GST rate that is relevant to different classes. Under the bound together arrangement of taxation, the GST rate is appropriate 5%, 12%, 18%, and 28%.

The formula of GST calculation

The formula for calculating GST is mentioned underneath:

- Include GST: Measure of GST = (Genuine Expense x GST%)/100

- Net Cost = Genuine Expense + Measure of GST

- Avoid GST: GST Sum = Genuine Expense – [Real Cost x {100/(100+GST%)}] Net Cost = Genuine Expense – Measure of GST

Advantage of GST Calculator

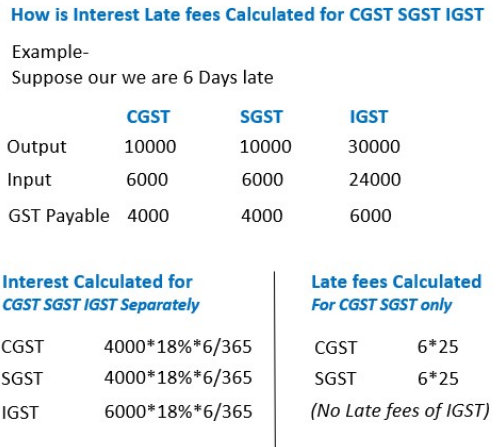

The GST on calculator is exceptionally helpful to find percentage-put together GST rates with respect to net or net merchandise products. It assists with finding the precise difference rate between CGST, SGST, and IGST. It saves a ton of time and likewise minimizes the opportunity of human mistake while calculating the total measure of labor and products.

All the business proprietor or individual connected with buy or supply of item must be pay tax under the GST system. However, the GST on calculator assumes a significant part in determining the exact GST pace of the net or gross products. It likewise calculates SGST, CGST, IGST, and UGST rates and gives the difference between them precisely.

Schedule of GST Rates for Products

The various rates for products under the labor and products tax are classified into seven kinds, coordinated into schedules in the GST charges manual for products. These are the subtleties:

- Schedule I: 0 points

- Schedule II: 0.25%

- Schedule III: 3%

- Schedule IV: 5%

- Schedule V: 12%

- Schedule VI: 18%

- Schedule VII: 28%

Uniformity in Taxation

The objective of GST on Calculator is to assist India with becoming a more connected economic culture by imposing consistent taxation rates and removing economic obstructions, resulting in a single national commercial center. The consolidation of the state and focal indirect taxation into a single tax would likewise help the public authority’s “Make in India” drive, as products fabricated or gave in the nation will contend in homegrown as well as in abroad commercial centers.

What are some tips for calculating percentage?

To find the percentage of a number, essentially increase that number by the decimal of the percent. For instance, to find what is 25% of 88, you increase 88 by .25 you get 22. Average Calculator If you have any desire to find 3% of 46, you duplicate 46 by .03 and get 1.38. 71% of 439 would be 311.69, and so on. Trust this answers your question.

Say, you need a square of 13. Do this: add 3 (the last digit) to 13 (the number to be squared) to get16 = 13 + 3. Square the last digit: 3² = 9. Add the outcome to the aggregate: 169.

As another model, find 14². To begin with, as before, add the last digit (4) to the actual number (14) to get18 = 14 + 4. Then, again as before, square the last digit: 4² = 16. You might want to attach the outcome (16) to the aggregate (18) getting 1816 which is plainly too huge, for, say, 14 < 20 so that 14² < 20² = 400. What you need to do is attach 6 and convey 1 to the past digit (8) making 14² = 196.

Some restaurants only charge service tax and some charge GST too, why the difference?

Service charge is nothing however the charge taken by restaurants for their services which includes tip of Page on waiters.so don’t feel bashful for not placing any ten notes or coins in that book like thing that convey bill slip inside it.

Service charge is 5-10 % of your total bill. Its simply restaurants the executives decision to conclude their service charge

Be that as it may, the standard here is the service charge ought to be conveyed to you preceding your request through the menu card or some other vouchers of the café. Implies you are ordering the things only subsequent to agreeing the service charge. On the off chance that it is not displayed anyplace you can without much of a stretch keep the installment from getting it.

So never under any circumstance pay more than 5.6 % of your total bill as service tax. You can decline to make good on service tax on the off chance that there is no forced air system in eatery you are visiting.

There are many issues relating the VAT and service tax as of now Service tax is applied on our 40% of the bill so VAT ought to be applied on remaining 60% of the bill. However this is precluded by government Page on specialists.

So unique State legislatures will have different VAT tax pieces. Likewise VAT is exacted in light of the things served too for instance VAT % is different for Liquor and food things in a similar café.

Leave a Reply