Benevolently allude to the client guide to make your tax installment through Generate Sales Tax Challan (ADC, for example, ATMs and Web Banking. The settle and post sales tax work methodology settles sales tax adjusts on the sales tax records, and counterbalances them to the sales tax settlement represent a given period.

You can download the utilization tax return to report and cover the tax or document for credit assuming you paid sales tax in another state. In view of the date of your buy, you should record the return by the pertinent quarterly due date. Knowing how to pay taxes for a Sales Tax Generator is muddled and, with the constantly influencing universe of sales tax guidelines, can rapidly prompt a cerebral pain.

Understanding the essential standards of sales tax, keeping away from some normal hindrances, and tracking down an exhaustive tax answer for assist you with pushing ahead, will bring proceeded with progress and development, regardless of your industry.

Installment While Recording through a Paper Return

To guarantee your installment is presented on your tax account, you should incorporate the eight-digit Colorado Record Number (CAN) on your check or cash request.

Excluding your Generate Sales Tax Challan postpone handling or potentially make the record have a money owed, which will bring about your business getting a Funds to be paid letter from the Office.

A Government Business ID Number (FEIN) isn’t equivalent to the CAN and won’t present the installment for you.

As of January 1, 2018, the Colorado Branch of Income (CDOR) requires all Colorado sales tax licensees to report and pay sales tax to the penny, paying little mind to documenting design.

How do private companies dispatch sales tax?

Knowing when and how to charge for sales tax is basic for entrepreneurs. However, paying – or dispatching – sales tax to the state or neighborhood government is similarly significant.

- Begin by deciding if you have a consistence commitment in a state. Assuming this is the case, register with your state’s taxing office prior to gathering any sales tax. After you’ve gone through the state’s enrollment cycle, you are then allowed to gather sales tax on your exchanges.

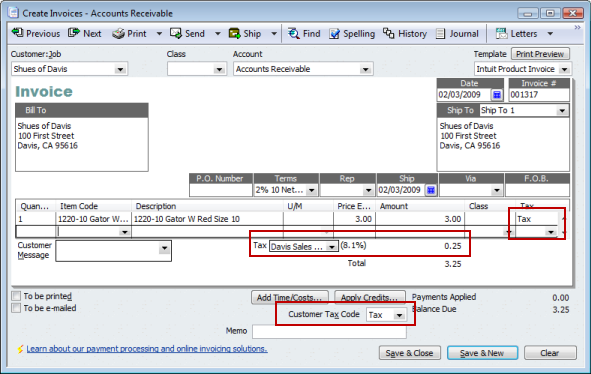

- Whenever you’ve started gathering tax, you’ll have to report the sales tax gathered on a receipt, and it should be recorded with the related tax ward in view of the Generate Sales Tax Challan due date and documenting recurrence set by each state. These can vary from state-to-state and can go from the center to the furthest limit of every month, except if you meet all requirements for a diminished recording recurrence.

- In certain occurrences, a sales tax return should be recorded despite the fact that your business didn’t gather sales tax during a particular documenting period. Regardless of whether your business wasn’t dynamic during a period, most states will require a return. Neglecting to do so can bring about a minor monetary punishment, however at times can bring about having your sales tax permit denied.

- Whenever you’ve amassed your sales tax in view of the prerequisites for each return, you are prepared to document your sales tax return. How you dispatch your tax will be different relying upon the state. While some have straightforward recording choices, and that implies only sorting out how much sales tax you gathered from purchasers in that state, others will expect you to separate the tax you gathered by other geological regions like city and province.

Assuming you have a sales tax charge, you ought to utilize the installment voucher that accompanies the “Generate Sales Tax Challan.” The installment and voucher ought to be sent to the location on the “Explanation of Record.” The main strategy for covering tax bills is with a money order or cash request with the voucher.

Leave a Reply