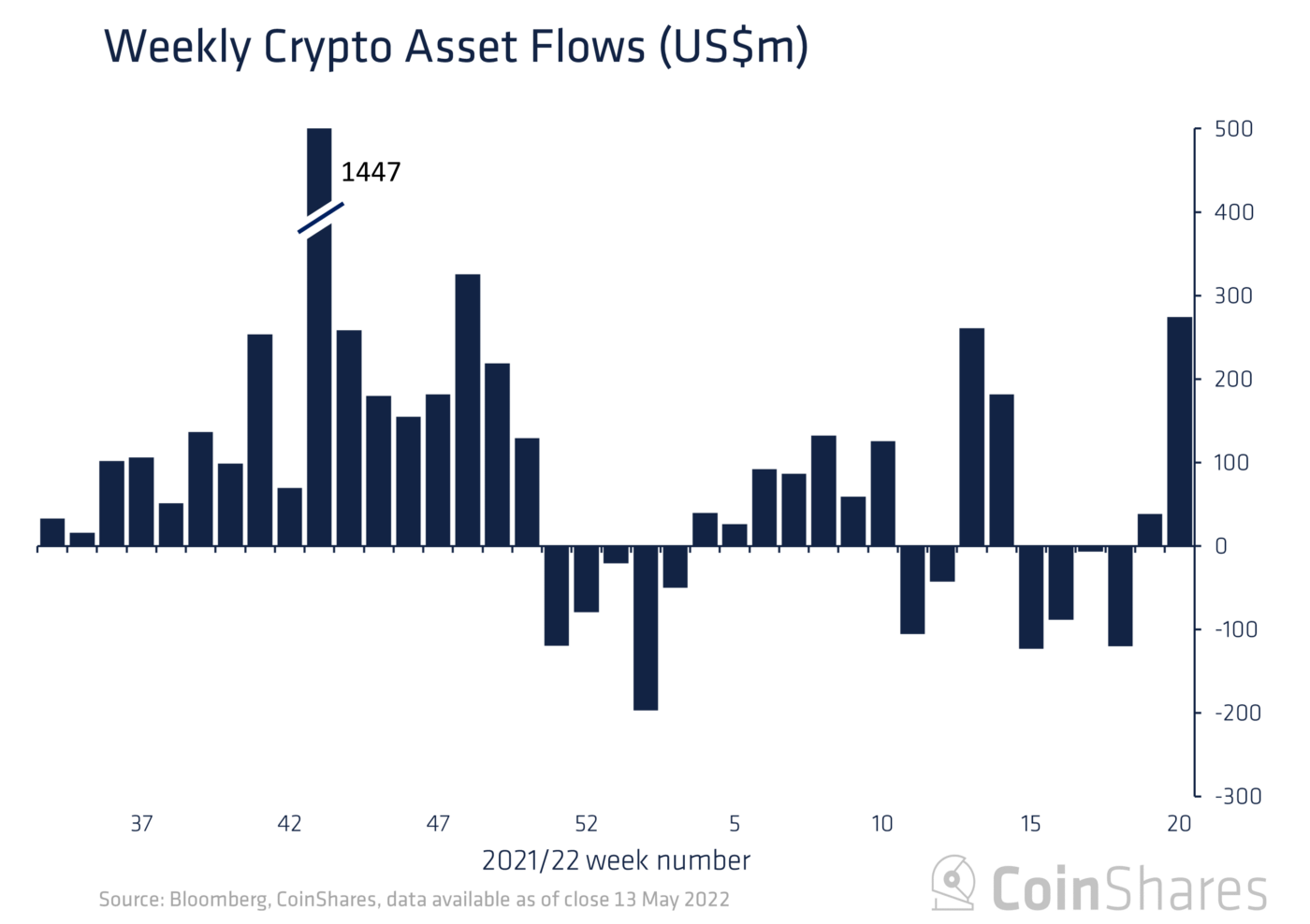

Computerized resource supports last week got their most elevated inflows since late 2021 as financial backers became involved with market alarm brought about by Terra’s collapse.

Crypto reserves piled up $274 million in inflows in the week through May 13, when the terraUSD stablecoin (UST) – a cryptographic money that should exchange at a proper cost of $1 – dropped to a couple of pennies, clearing out the vast majority of its $18 billion market capitalization and furthermore making the blockchain’s local symbolic LUNA, when a main 10 digital currency, practically useless.

James Butterfill, head of examination at CoinShares, said it was “areas of strength for a that financial backers saw the new UST stablecoin depeg and its related wide auction as a purchasing an open door.”

Bitcoin-centered reserves were the unmistakable champs, netting $299 million in inflows, the most elevated week by week inflow since the last seven day stretch of October 2021. That’s what the information recommends “financial backers were rushing to the general security of the biggest computerized resource,” Butterfill said.

The whirlwind of speculation came as bitcoin (BTC) plunged to as low as $25,892 on Thursday in the midst of fears Luna Foundation Guard, the association that should uphold UST in an emergency, could overreact sell its save of around 80,000 bitcoin. The cost of bitcoin recuperated most assuming that its misfortunes toward the end of last week to switch hands up $30,000, a critical mental level.

Financial backers were spellbound topographically on the grounds that subsidizes recorded in North American saw $312 million of inflows, while $32 million streamed out of European assets.

Bitcoin ETF

Reason, the supplier of the biggest bitcoin trade exchanged reserve recorded in Canada, booked $284 million in inflows, overshadowing streams of contenders.

Non-bitcoin reserves battled in the market auction, as some $26.7 million streamed out of assets overseeing ether (ETH), while vehicles zeroed in on solana (SOL) recorded $5 million of surges.

Financial backers in blockchain-related stocks evidently terrified, with some $51 million leaving subsidizes that oversee blockchain and crypto-centered values.

Interestingly, multi-resource reserves, which oversee more than one digital currency, kept $8.6 million in inflows, proposing that a few financial backers favored a differentiated methodology.

Also Read: The Aya Neo 2 and Aya Neo Slide have features that can challenge the Steam Deck

Leave a Reply