Labor and products Expense which is shortened as GST as duty that has been forced by the Public authority of India at the public level. A few GST Calculators are accessible on web-based sites which can be used to decide the GST cost.

The GST imposed by the Public authority of India on the venders, makers, and customers of labor and products at a public level. GST is gotten from the idea of Significant worth Added Expense (Tank) and that implies that it is applied at each stage and the buyer should pay the GST sum which is charged by last seller or the provider in the store network.

GST calculator assists you with figuring out one or the other net or gross cost of your item founded on a rate based GST (Labor and products Duty) rate. It’s direct to use – give esteems that you know (for instance, net cost and GST rate) to get different qualities (for this situation, gross cost and duty sum).

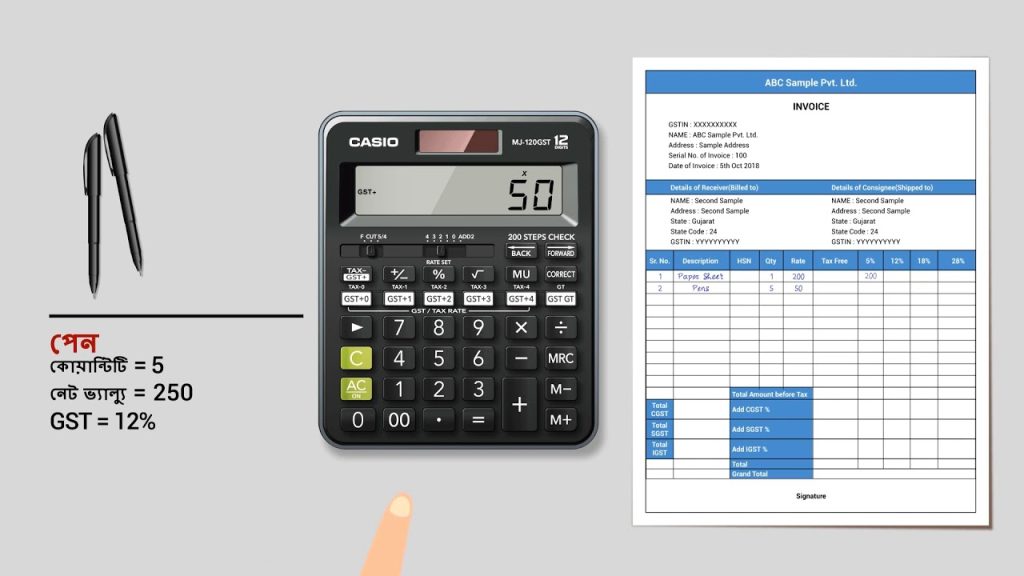

While it is basic to enlist and record GST on your deals, understanding the course of computation of GST is likewise fundamental. As an enrolled organization in India, all brokers and financial specialists should get a GSTIN (GST Distinguishing proof Number) and In this article, we will investigate the estimation of GST, the different duty chunks under GST, and a lot more related and fundamental How to Use GST Calculator computation.

What is GST?

An extensive duty demanded on the stockpile of labor and products in India is called Labor and products Expense, for example GST. Essentially since first July 2017, the GST was executed as a solitary duty framework to supplant the majority of the other backhanded charges around then. The other expense frameworks that were nullified and supplanted were the Focal Extract Obligation, Section Duty, Tank, Octroi, and so forth.

Being a far reaching charge framework, GST Calculator is imposed on the creation/assembling, deal, and utilization of the delivered merchandise the nation over. A wide range of ventures, huge or little, should have a GSTIN – GST Distinguishing proof Number-to enroll themselves under the duty arrangement of GST.

For the situation where the exchange is occurring inside the states for example on account of the Between state exchanges, Coordinated GST is exacted; while, on account of any deals occurring intra-state, Focal GST and the State GST come into the image for being imposed.

These are the various types of GST gathered by the public authority:

- State GST: Likewise called SGST, it is gathered by the State Government.

- Focal GST: Additionally called CGST, it is gathered by the Focal Government.

- Incorporated GST: Likewise called IGST, is to be paid to the Focal Government for between state exchanges.

- Association Territory GST: Additionally called UTGST, it is to be paid to the Association Territory State run administrations. Every one of the 5 UTs-Dadra and Nagar Haveli, Chandigarh, Andaman and Nicobar Islands, Lakshadweep, and Daman and Diu force the UTGST.

How to Calculate GST?

As a Purchaser, to work out the GST on your products, you should be know all about the Net Cost of the great and the comparing GST rate that applies to that great (5%, 12%..and so on).

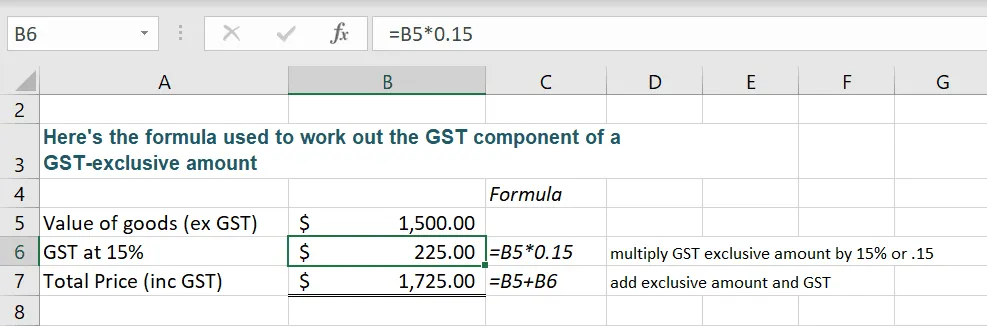

GST Calculations Formula

It is easy to compute the GST utilizing the equation given here:

At the point when the GST is prohibited:

- GST = Supply Worth x GST%/100

Cost of the Upside = Supply Worth + Measure of GST

At the point when the GST is remembered for the inventory esteem

- GST = Supply Worth – [Supply Worth x {100/(100+GST%)}]

How can Deskera Assist You with Working out GST?

With Deskera Books, you can direct business anyplace in India through a straightforward web-based stage that works on the GST Calculator bookkeeping framework.

It is a creative framework for invoicing, bookkeeping, and different perspectives connected with bookkeeping, for example, fixed resources, buy request and receipt, credit note. Generally, Deskera Books is an across the board put that assists organizations with zeroing in on their center undertakings and objective achievement.

Make savvy reports to monitor relevant rates for all state GSTs, focal GSTs, and incorporated GSTs inside one book framework.

Leave a Reply