Seagate Technology Reports Fiscal First Quarter 2023 Financial Results, Seagate Technology Holdings plc (NASDAQ: STX) (the “Company” or “Seagate”) today reported financial results for its fiscal first quarter ended September 30, 2022.

“Global economic uncertainties and broad-based customer inventory corrections worsened in the latter stages of the September quarter, and these dynamics are reflected in both near-term industry demand and Seagate’s financial performance. We have taken quick and decisive actions to respond to current market conditions and enhance long-term profitability, including adjusting our production output and annual capital expenditure plans, and announcing a restructuring plan that will deliver meaningful cost savings while maintaining investments in the mass capacity solutions driving our future growth,” said Dave Mosley, Seagate’s chief executive officer.

“We continue to meet our development milestones for the 30+ terabyte product family, which is based on industry leading HAMR technology. Our team is executing well on our innovation roadmap, and we are seeing strong engagement from cloud customers. Looking beyond the current macro uncertainties, we are confident in the secular demand for mass capacity storage driven by the underlying growth in data and believe Seagate is in a great position to capture growth opportunities over the long-term.”

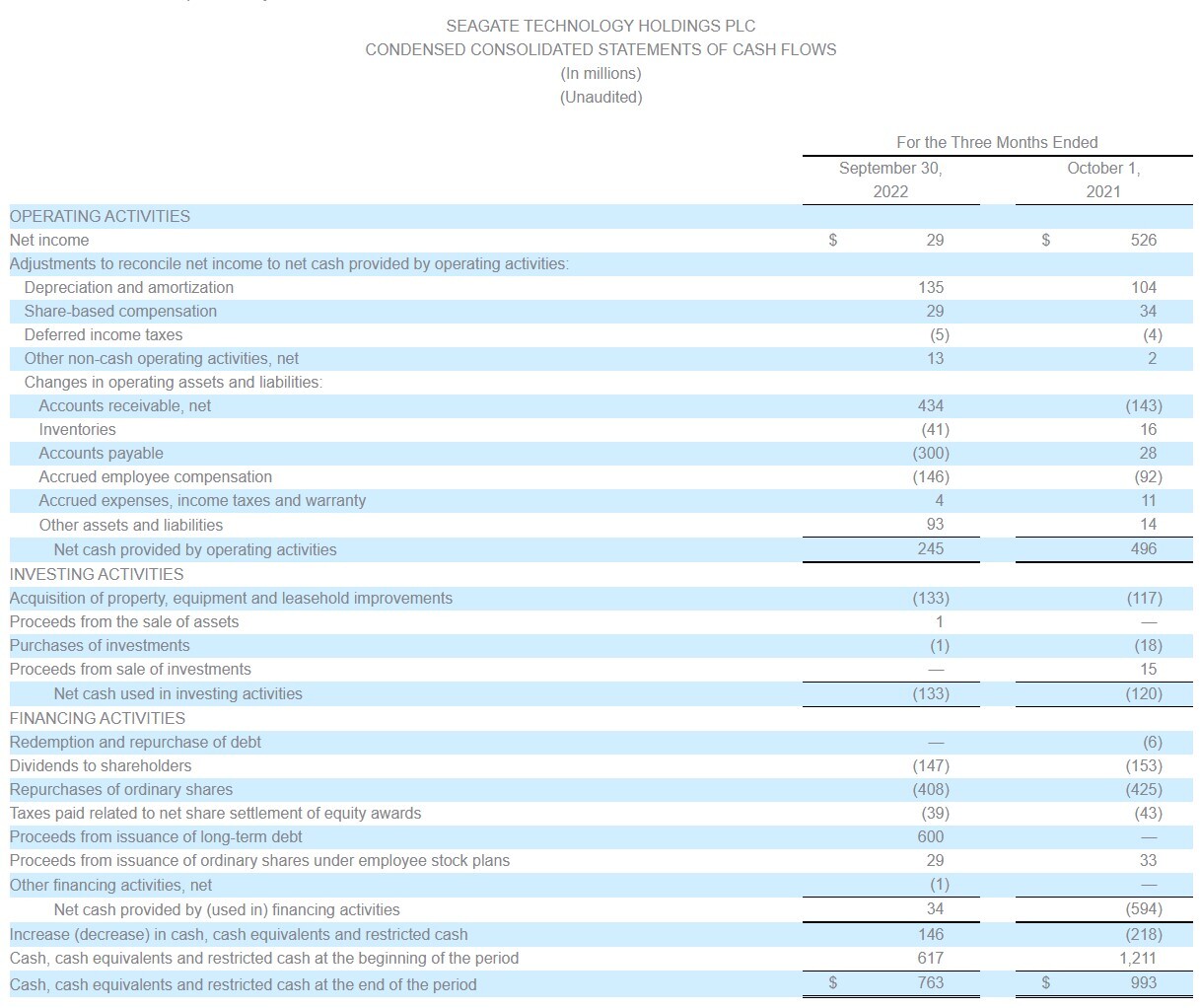

During the fiscal first quarter the Company generated $245 million in cash flow from operations and $112 million in free cash flow, paid cash dividends of $147 million and repurchased 5.4 million ordinary shares for $408 million. The Company raised $600 million in new capital through a new term loan facility, exiting the fiscal first quarter with cash and cash equivalents totaling $761 million. There were 206 million ordinary shares issued and outstanding as of the end of the quarter.

For a detailed reconciliation of GAAP to non-GAAP results, see accompanying financial tables.

Seagate has issued a Supplemental Financial Information document UK Lawmakers Vote to Recognize, which is available on Seagate’s Investor Relations website at investors.seagate.com.

Quarterly Cash Dividend

The Board of Directors of the Company (the “Board”) declared a quarterly cash dividend of $0.70 per share, which will be payable on January 5, 2023 to shareholders of record as of the close of business on December 21, 2022. The payment of any future quarterly dividends will be at the discretion of the Board and will be dependent upon Seagate’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the Board.

Restructuring Plan

On October 24, 2022, the Company’s Board of Directors approved and committed to a restructuring plan (the “Plan”) to reduce its cost structure to better align the Company’s operational needs to current economic conditions while continuing to support the long-term business strategy. The Plan includes reducing its worldwide headcount by approximately 3,000 employees, or 8% of the global workforce, along with other cost saving measures.

The Plan, which the Company expects to be substantially completed by the end of the fiscal second quarter 2023, is expected to result in total pre-tax charges between $60 million and $70 million. The charges are expected to be primarily cash-based and consist of employee severance and other one-time termination benefits.

The Company expects to realize run-rate savings of approximately $110 million on an annualized basis starting in the fiscal third quarter 2023.

Business Outlook

The business outlook for the fiscal second quarter 2023 is based on our current assumptions and expectations; actual results may differ materially, as a result of, among other things, the important factors discussed in the Cautionary Note Regarding Forward-Looking Statements section of this release.

The Company is providing the following guidance for its fiscal second quarter 2023:

Revenue of $1.85 billion, plus or minus $150 million

Non-GAAP diluted EPS of $0.15, plus or minus $0.20

Guidance regarding non-GAAP diluted EPS excludes known pre-tax charges related to amortization of acquired intangible assets of $0.01 per share, estimated share-based compensation expenses of $0.18 per share, and restructuring costs of $0.29 to $0.34 per share.

We have not reconciled our non-GAAP diluted EPS guidance for fiscal second quarter 2023 to the most directly comparable GAAP measure because material items that may impact these measures are out of our control and/or cannot be reasonably predicted, including, but not limited to, accelerated depreciation, impairment and other charges related to cost saving efforts, pandemic-related lockdown charges, losses and costs on the modification or redemption and repurchase of debt, strategic investment losses (gains) or impairment charges, income tax adjustments on these measures, and other charges or benefits that may arise. The amounts of these measures are not currently available but may be material to future results. A reconciliation of the non-GAAP diluted EPS guidance for fiscal second quarter 2023 to the corresponding GAAP measures is not available without unreasonable effort. A reconciliation of our historical non-GAAP financial measures to their nearest GAAP equivalent is contained in this release.

Investor Communications

Seagate management will hold a public webcast today at 6:00 AM PT / 9:00 AM ET that can be accessed on its Investor Relations website at investors.seagate.com.

An archived audio webcast of this event will be available on Seagate’s Investor Relations website at investors.seagate.com shortly following the event conclusion.

Leave a Reply