Public information recommends that few unknown crypto financial backers benefitted from inside information on when tokens would be recorded on trades.

North of six days last August, one crypto wallet amassed a stake of $360,000 worth of Gnosis coins, a token attached to a work to assemble blockchain-based expectation markets. On the seventh day, Binance — the world’s biggest digital money trade by volume — said in a blog entry that it would list Gnosis, permitting it to be exchanged among its clients.

Token postings add both liquidity and a stamp of authenticity to the token, and frequently give a lift to a symbolic’s exchanging cost. The cost of Gnosis rose strongly, from around $300 to $410 soon. The worth of Gnosis exchanged that day flooded to in excess of multiple times its seven-day normal.

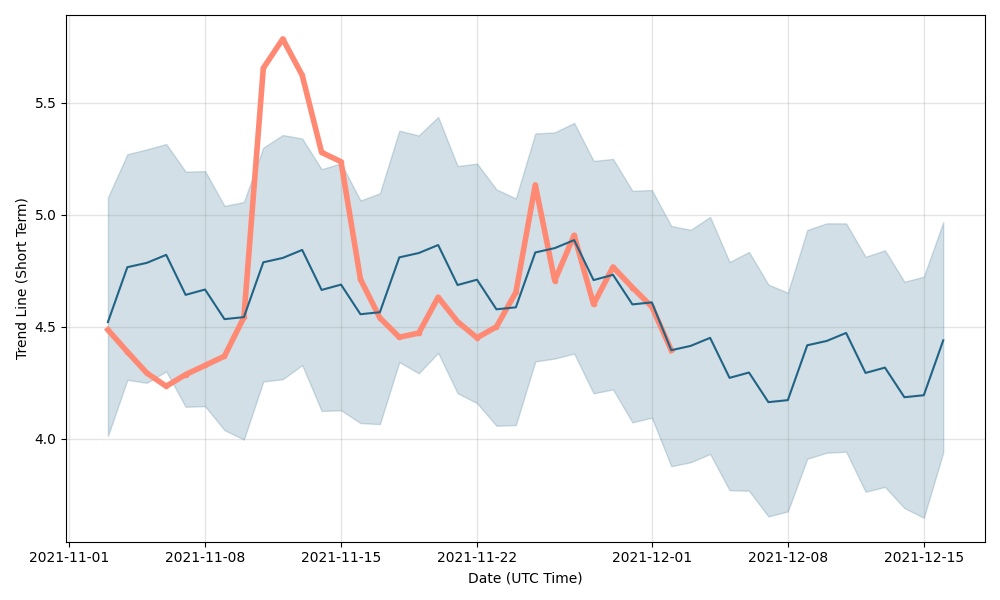

Four minutes after Binance’s declaration, the wallet started selling down its stake, exchanging it totally in a little more than four hours for somewhat more than $500,000 — netting a benefit of about $140,000 and an arrival of generally 40%, as per an investigation performed by Argus Inc., a firm that offers organizations programming to oversee worker exchanging. A similar wallet exhibited comparative examples of purchasing tokens before their postings and selling rapidly after with undoubtedly three different tokens.

The crypto biological system is progressively wrestling with migraines that the universe of customary money handled many years prior. The breakdown of an alleged stablecoin from its dollar stake prior this month originated from crypto’s form of a bank run. How digital currency trades keep market-delicate data from spilling has likewise turned into a developing subject of concern. The center comes as controllers are bringing up issues about the market’s decency for retail clients, a considerable lot of whom just reserved significant misfortunes on steep decreases in crypto resources.

The wallet purchasing Gnosis was among 46 that Argus found that bought a consolidated $17.3 million worth of tokens that were recorded soon after on Coinbase, COIN – 1.88% Binance and FTX. The wallets’ proprietors not set in stone through the public blockchain.

Benefits from deals of the tokens that were noticeable on the blockchain added up to more than $1.7 million. The genuine benefits from the exchanges is possible altogether higher, be that as it may, as a few lumps of the stakes were moved from the wallets into trades instead of exchanged straightforwardly for stablecoins or different monetary forms, Argus said.

Argus zeroed in just on wallets that showed rehashed examples of purchasing tokens in the approach a posting declaration and selling before long. The examination hailed exchanging movement from February 2021 through April of this current year. The information was inspected by The Wall Street Journal.

Coinbase, Binance and FTX each said they had consistence approaches denying workers from exchanging on favored data. The last two said they looked into the examination and verified that the exchanging movement Argus’ report didn’t abuse their strategies. Binance’s representative likewise expressed the wallet addresses were not generally connected to its workers.

Coinbase said it conducts comparable investigations as a feature of its endeavors to guarantee reasonableness. Coinbase leaders have posted a progression of web journals addressing the issue of front running.

“There is generally the likelihood that somebody inside Coinbase would be able, wittingly or accidentally, spill data to pariahs taking part in criminal behavior,” Coinbase Chief Executive Brian Armstrong composed a month ago. The trade, he said, explores representatives that seem connected to front running and ends them assuming they are found to have supported such exchanges.

Paul Grewal, Coinbase’s boss lawful official, circled back to a blog entry Thursday. The organization has seen data about postings spill before declarations through brokers distinguishing advanced proof of trades testing a token before a public declaration, he said. Coinbase has done whatever it may take to alleviate that notwithstanding its endeavors to forestall representative insider exchanging, he said.

Wallets like these have caused banter in the crypto local area about whether designated purchasing of explicit tokens in front of postings on trades focuses to insider exchanging. The crypto markets are generally unregulated. Lately, controllers have looked all the more carefully at the market’s reasonableness for individual financial backers. The biggest digital money bitcoin has fallen 24% in May, causing steep misfortunes for individual financial backers across the market.

Insider exchanging regulations bar financial backers from exchanging stocks or items on material nonpublic data, for example, information on an approaching posting or consolidation offer.

A few legal counselors say that current criminal resolutions and different guidelines could be utilized to pursue those exchanging digital forms of money with private data. However, others in the cryptographic money industry say an absence of case point of reference well defined for crypto insider exchanging has made vulnerability about whether and how controllers could try to handle it later on.

Argus CEO Owen Rapaport said that inner consistence strategies in crypto can be undermined by an absence of clear administrative rules, the freedom supporter ethos of numerous who work in the space and the absence of systematized standards against insider exchanging crypto contrasted and those in conventional money.

“Firms have genuine difficulties with ensuring the set of rules against insider exchanging — which pretty much every firm has — is really followed as opposed to being an idle piece of paper,” Mr. Rapaport said.

Protections and Exchange Commission Chairman Gary Gensler said Monday that he saw similitudes between the deluge of individual financial backers into crypto markets and the stock blast of the 1920s that augured the Great Depression, which prompted the making of the SEC and its command to safeguard investors.”The retail open had gotten profoundly into the business sectors during the 1920s and we perceived how that emerged,” Mr. Gensler said. “Try not to allow someone to say ‘Well, we don’t have to safeguard against extortion and control.’ That’s where you lose trust in business sectors.”

Representatives for the trades said that they have strategies to guarantee that their workers can’t compromise of delicate data.

A Binance representative said that workers have a 90-day hang on any ventures they make and that innovators in the organization are commanded to report any exchanging movement on a quarterly premise.

Also Read: Next Week Obi-Wan is coming to Fortnite

Leave a Reply